-

-

-

- While we are being distracted with the theatrics of

these long months of presidential canidates theatrics and hollow rehtoric,

the grave issues in our nation (purposefully) are being ignored. The

latest antics has Michigan (in ecomomic free fall) ignored by the party

(Democratic) that once represented the working man. This because of rules

(?) that punished Michigan for holding its primary too early. Now they

are told they cannot send delegates to the National Convention. That's

par for the course - why would the voice of the dispossessed be represented?

-

-

-

-

- Jeffrey, age 49, lost his auto plant job in Aug. He

has had to move in with his mother. Jeffrey says, "I lost everything

I worked for all my life." John McCain's message was, "The jobs

aren't coming back".

-

- I'm not impressed with McCain (having never worked in

the real world) advising the hundreds of thousands laid off (losing homes)

to go back to college. He tells these hundreds of thousands from his removed

affluence - "The jobs are never coming back". This shows you

how detached those in Foggy Bottom are to the working man/woman. The arguments

in SC - today say it's a race issue. Who loves Blacks more? Huckabee

is still doing his hokum song fest (guitar) and promising a chicken in

every pot (Tyson that is). His newest delusion is to change the constitution

to line it up with Scripture. On and on it goes - while in the working

man's world millions are losing their homes. There's an economic meltdown

going on in the financial markets. The canidates say it needs studied.

The REAL story has yet to be told to the American public. The ONE Question

that should have been asked in these forever "Groundhog Day"

debates has yet to be asked? These managed 'debates' (sniping contests)

have yet to touch our domestic carnival of errors. You'd think we were

electing a prom king or queen. Citizens are being treated like pet gerbils

running round and round on a wheel of partronizing dribble and lies.

-

- Both parties have been complicit over these past decades

in the meltdown we're witnessing. People need to climb down off their

elephants and donkeys. They need to discard their red - white - and boo

attire and enter into the neutral zone. As long as people can be kept in

the arena of elephant dung and donkey drippings they'll remain ignorant

to the facts that will vitally affect their lives and their children.

-

- REAL ESTATE: This problem began in the early 90s. This

is when the Federal Reserve began lowering the costs of funds and banks

encouraged people to borrow at low rates. Mortgage rates were lowered in

1991. This is when credit lines using home equity were created by your

friendly banker. That was when people began going into debt up to their

eyeballs using the inflationary increases in the value of their primary

residence as a personal ATM machine! People forgot that the only true value

in real property is the equity. Market estimates of home values can drop

50% in one day.

-

-

-

-

-

- Why would the Federal Reserve do something so harmful

to the national economy? When a bank makes a loan of $100,000, ninety per

cent of that amount ( or, $90,000) creates new money out of thin air. This

is called 'fractional - reserve' banking. It is a system used in most nations

worldwide. Most nations have central banks - the Federal Reserve is a central

bank. It is not a federal agency as most people have been led to believe.

It is a cartel of privately owned bankers and other affluents - much like

OPEC is owned by people in oil producing nations.

-

- When Congress are over spending like mindless idiots,

when the cost of war is approximately $245 million a day, one of the best

ways to create money to pay these costs is to encourage American consumers

to borrow. Every time you borrow - ninety percent of that amount creates

new money from thin air. That money is injected into the economy. As long

as we all borrow more and more and more money from banks more money is

created.

-

-

-

-

-

- No wonder borrowing was made so easy - it gave them the

cash they needed for all that spending. Every good thing comes to an end.

Expect an economic upheaval when Washington's cash cow quits giving milk.

-

- "All of the perplexities, confusion, and distress

in America arises, not from the defects of the Constitution or Confederation,

not from want of honor or virtue, so much as from downright ignorance of

the nature of coin, credit, and circulation" John Adams, Founding

Father

-

- Congressman Louis T. McFadden, (therefore knowledgeable)

was a banker. He headed the Congressional Banking Committee for 11

years. He stated the following (in part) before Congress on June 10, 1932.

"Mr. Chairman, we have in this country one of the most corrupt institutions

the world has ever known. I refer to the Federal Reserve Board and the

Federal Reserve Banks. The Federal Board, has cheated the Government of

the United States and the people of the United States out of enough money

to pay the national debt. This evil institution has impoverished and ruined

the people of the U.S.; has bankrupted itself, and has practically bankrupted

our government. It has done this through the defects of the law under which

it operates, through the maladministration of that law by the Federal Reserve

Board, and through the corrupt practices of the moneyed vultures who control

it."

-

-

-

- The Depression was a severe crisis in banking history.

Between 1930 and 1933 more than 9000 banks close their doors and investments

decreased by 90%. Ninety per cent of small community banks failed. By 1933

the banking system was a wreck. Congressional hearings in early 1933 revealed

gross irresponsibility on the part of major banks, which had used billions

of dollars of depositor's funds to acquire stocks and bonds and had made

unsound loans to inflate the prices of these securities. The Banking Act

of 1933 (the Glass-Stegall Act), was passed by Congress in the face of

vociferous opposition from the American banking community. This act prohibited

commercial banks from using their own assets to invest in securities (such

as stocks and bonds).

-

- In his 'Economic History of the Great Depression', John

Galbraith pointed out one of the causes: "The large scale corporate

thimblerigging that was going on. This took a variety of forms, of which

by far the most common was the organization of corporations to hold stock

in yet other corporations, which in turn held stock in yet other corporations.

During 1929 one investment house, Goldman Sachs and Company, organized

and sold nearly a billion dollars' worth of securities in three interconnected

investment trusts . All eventually depreciated virtually to nothing."

- Progressive Historians - Nov 27, 2007, Ralph Brauer

-

- In 1971, in Investment Company v. Camp, no less than

the United States Supreme Court would write what stands as the most cogent

summary for the Banking Act (Glass-Steagall). "Congress was concerned

that commercial banks in general and member banks of the Federal Reserve

System in particular had both aggravated and been damaged by stock market

decline partly because of their direct and indirect involvement in the

trading and ownership of speculative securities." Supreme Court No.

61 argued Dec 15-1970: http://supreme.justia.com/us/401/617/case.html

-

- FAST FORWARD: The chief aim of the money men (assisted

by both Republicans and Democrats) for decades was to roll back FDR's

New Deal. Anti-government rhetoric ( distracting labeling) has hidden this

from public view. The 'Banking Act' of the New Deal was a priority by vested

interests in being repealed. The undoing of this Act took decades and

approximately $200 million in lobbying funds to accomplish.

-

- "Billionaire Sanford Weill made 'Citigroup' into

the most powerful financial institutions since the House of Morgan a century

ago. A major trophy of Sanford's is the pen Bill Clinton used to sign the

REPEAL of FDR's Banking Act - a move which allowed Weill to create Citigroup.

" Sanford Weill called President Clinton to break the deadlock after

Senator Phil Gramm, chairman of the Banking Committee, warned Citigroup

LOBBYIST Roger Levy that Weill has to get the White House moving on the

bill or he would shut down the House-Senate Conference. A deal was announced

at 2:45 a.m. Just days after the Clinton administration (including the

Treasury Department) agrees to support the REPEAL, Treasury Secretary Robert

Rubin, the former co-chairman of a major Wall Street investment bank, Goldman

Sachs, raises eyebrows by accepting a top job at Citigroup as Weill's chief

lieutenant. The previous year, Weill had called Rubin to give him advance

notice of the upcoming merger announcement. When Weill told Rubin he had

some important news, the secretary reportedly quipped, "You're buying

the government." Progressive Historian

-

-

-

-

-

- With the stroke of a pen, Bill Clinton ended the long

saga of Republicans and Democrats, working in concert, for their puppet

masters (the bankers) with his signing of the 'Financial Modernization

Bill' (Nov 12, 1991). Clinton ended an era that stretched back to William

Jennings Bryan and Woodrow Wilson and reached fruition with FDR and Harry

Truman. As he signed his name, William Jefferson Clinton symbolically signed

the death warrant of a level playing field that had guided the Democratic

Party. Clinton (both parties) knew better than FDR and our Supreme Court.

Nov 12-1999, President Clinton stated, " Glass- Stegal (FDR Banking

Bill) is no longer appropriate for our economy. This was good for the industrial

age. The (1999) Financial Modernization Bill is the key to rising paycheck

and great security for ordinary Americans". Tell this to Michigan

- NH - California - Georgia etc. The public was distracted from one

of the most important pieces of legislation in this nation's history being

signed by Bill Clinton, with round the clock coverage, of the Monica debacle.

Seeing how Clinton came out of this shameful episode lauded as heroic

- super stud - and a multi-millionaire, why one one would almost think

that the whole sordid affair was contrived? Most especially with Lieberman

acting as the holier than thou apologist ! Missed was Clinton's reason

for the undoing of FDR's landmark bill Press release: http://Treas.gov/press/releases/ls241.htm

-

- What does this repeal mean? The hedge fund industry

and subprime mortgage market is out of control. The New York Times in

a June 2007 profile of Goldman Sachs: "While Wall Street still mints

money advising companies on mergers and taking them public, real money

- staggering money - is made trading and investing capital through a global

array of mind bending products and strategies unimaginable a decade ago."

-

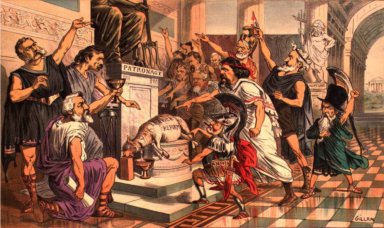

- Goldman Sachs head Lloyd Blankfein paints the perfect

picture of what has happened: "We've come full circle, because this

is exactly what the Rothschild's or J.P. Morgan the banker were doing in

their heyday. What caused an aberration was the Glass-Steagall Act (FDRs

- Banking Act)." Blankfein, like his cohorts in corporate greed,

sees the New Deal as an aberration and longs for a return to the

Gilded Age.

-

-

-

-

-

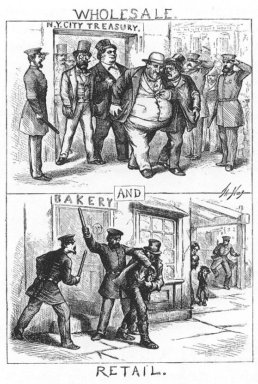

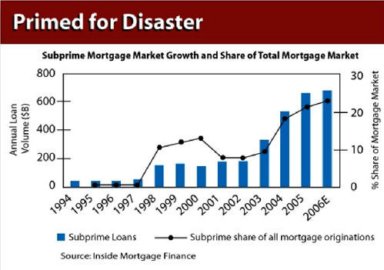

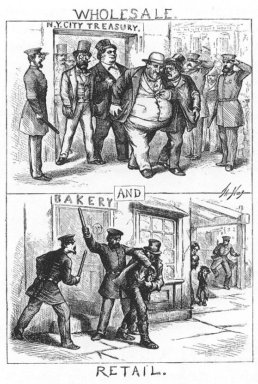

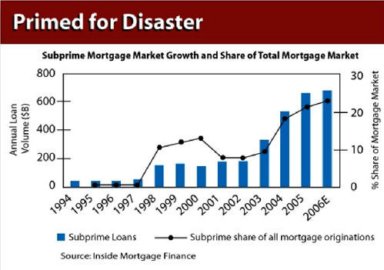

- Level playing field? Notice how flat it was before the

REPEAL of FDR's Banking Act. Those subprime loans amount to nothing more

than an organized ripoff of millions of Americans with the steepness of

the graph illustrates how far the playing field has titled. Robert Kutter

(Stanford University) testified before Barney Frank's Committee on Banking

and Financial Services in Oct 2007 " Since repeal of Glass Stegall

(FDR Banking Act) in 1999, after more than a decade of de facto inroads,

super banks have been able to re-enact the same kinds of structual conflicts

of interest that were endemic in the 1920s - tending to speculators, packaging

and securitizing credits and then selling them off, wholesale or retail,

and extracting fees at every step along the way. And, much of this paper

is even more opaque to bank examiners than its counterparts were in the

1920s. Much of it isn't paper at all, and the whole process is supercharged

and automated formulas."

-

-

-

-

- To the Victor goes the spoils - burp! It's lonely at

the top, but you eat better!

-

- 2008 - Citigroup. The repeal (Clinton's Financial Modernization

Bill) of FDR's Banking Act - was responsible for the creation of Citigroup

as an all-purpose financial supermarket and too - big- to fail banking

marvel..(much like the unsinkable Titanic?). Investment bankers lobbied

for thirty years to repeal the Glass-Steagall Act, which separated commercial

banking from its investment house cousins. Wall Street hated the law but

failed year after year to win repeal. The problem was always the Democrats

(since Republicans were supporters).

-

- In enters a reincarnation of our old carnival snake oil

salesman. Bill Clinton delivered his 'New Democrat Party' with a lot of

the usual scripted rhetoric. Meaningless made up words. The combination

of insurance, investment banking, and old-line commercial banks, have

multiplied the conflicts of interest within banks, despite so-called 'firewalls'.

Much like Enron, placing some deals in off-balance sheet entries did not

insulate Citigroup from losses in its swollen subprime housing lending.

The bank (Citigroup) has so far written off something like $15 billion

and there's more to come. Ah - but meantime we're going to see these presidential

canidates argue over who loves Blacks the most - or the miracle of Hillary's

tears ! It's interesting that in the Neveda debates (Nov 15), when Hillary

was asked about Citigroup and the subprime debacle she responded, that

that she was concerned over these huge pools of money, and that Congress

and the Federal Reserve need to ask questions. She went on to remark on

how mortgages (subprime and conventional) were being bundled and sold to

foreign investors. THE 64,000 QUESTION (yet to be addressed in these debates)

was not asked: 'Senator Clinton, its a known fact, that Citigroup would

not exist, except for President Clinton's repeal of FDR's 'Banking Act'.

Would you (other canidates) not agree with the 1971 Supreme Court ruling,

Goldman Sachs, and testimony by economists, that we have re-enacted the

same conflicts of interest that were in place before the Great Depression

and thus are doing the very same things that the Rothschild's and J.P

Morgan were guilty of?' This is the question that has yet to be asked

in any of these 'debates' (Republican or Democrat). The media and canidates

blame the victims or wander off into some escoteric meaningless gibberish.

-

-

-

-

-

- "Practices of the unscrupulous money changers stand

indicted in the court of public opinion, rejected by the hearts and minds

of men. They have no vision and where there is no vision the people perish".

FDR First Inaugural Address

-

-

-

-

-

- Rest assured we'll hear the same sorry blame game -

with each party (both complicit in this debacle) them) blaming the other.

Hillary is worried about repairing the image of America. Nobody is asking

these candidates about the disasterous REPEAL of the Banking Act of 1933,

which is leaving millions (not them) foreclosed on and losing jobs, investments,

and pensions etc! When people are losing their jobs, homes, and children's

futures; like their grandparents or great grandparents of old, they don't

give a damn about 'image'. They are focused on having a roof over their

heads and food to eat. The attention to the export of jobs in the U.S.

did not develop until white - collar jobs began to evaporate along with

manufacturing jobs with no replacement jobs. A U.S. company can hire a

software developer in India for $6.00 an hour according to the McKinsey

Global Institute. A data - entry clerk earns $2.00 an hour in India.

-

-

-

-

- The presidential - canidates (Jan 15-2008) report that

we're spending $10 billion a month on war. Ten billion a month, as multitudes

lose their homes over medical costs (hospitalization) and job losses that

bankrupt them. A $600 per day hospital fee soon brings a family to ruination.

The working man doesn't have the smörgåsbord of medical coverage

(tax payer subsidized) that those in elected office have secured for themselves

(prescriptions covered - dental - eyeglasses). Note they promise that someday

the citizens may have affordable health care. Meantime those promising

affordable health care, if elected, are receiving bundles of campaign

money from the insurance companies & pharmaceuticals. These (lobbyists)

are the people that wrote the bills that made the cost of prescriptions

prohibitive, and excused them from liabilities, should a vaccine kill

you or render your child brain damaged! Whose interests do you think these

canidates will be serving? Today we see the promises of the last election

serving OIL interests to the tune of obscene billions in profits. Not

mentioned these past few days, is the recent $4,100 raise (Jan - 2008)

that Congress gave itself. The Supreme Court and Dick Cheney also got

raises. The President's salary stays at $400,000. Nancy Pelosi will now

be making $217,000. This for working Tue through Thur (not counting the

numerous recesses). These salaries are for an approximate 151 days. The

excuse offered, is how much they work when they go home. I've yet to see

this - except for some convenient photo-op. The ordinary guy misses work

and he's fired. As for paid vacations - those are a rarity.

-

-

-

-

-

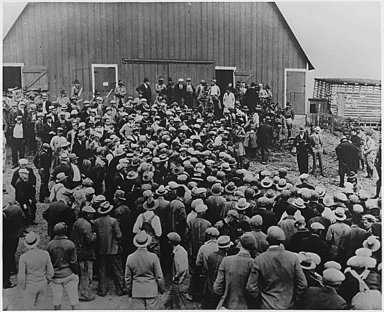

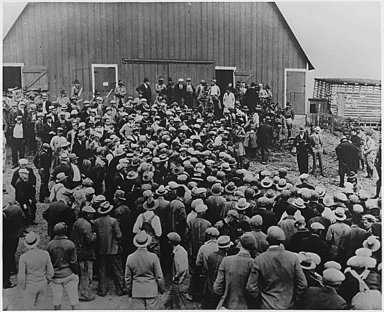

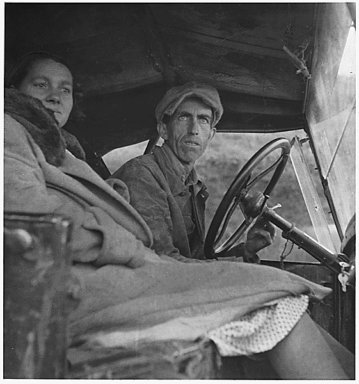

- During the Great Depression (not taught in schools) millions

lost their farms and homes (due to bankers greed). It's hard to imagine

(maybe not with Clinton's repeal of Banking Act ?) what it felt like to

walk through the door of their bank and learn that the dollars that had

earned had vanished. Every day spent working and saving had been for nothing.

The people believed (they were right) that the bankers had stolen their

lives. To stave off Banks selling farms at public auction - farmers from

the area would gather at the farm up for sale. They would start bids at

15 cents which rarely got above a $1.00. Outsiders were kept from attending.

If someone made a serious bid, a burly man would put a hand on his shoulder

and say, "That bid's a little high ain't it?" These were known

as Penny Auctions.

-

-

-

-

-

-

-

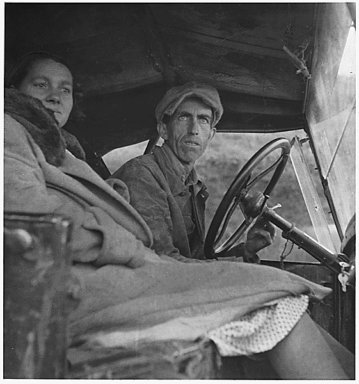

- Fast forward to 2008. The repeal of FDR's Banking Act

in 1999, with the promise of "increased wages and security for

workers" sees auctions such as the one above (California) taking

place from coast to coast. These folks (speculators) are benefiting from

the hardships of others. The Penny Auction to help one's neighbor against

the greed of banks and lenders, has been replaced with the thought of

getting a 'real deal'.

-

-

-

-

-

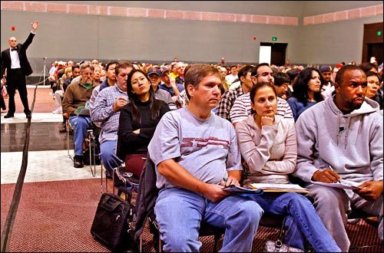

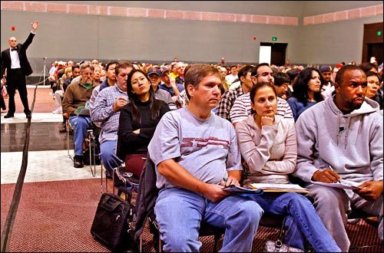

- 2008 - The promise of Bill Clinton (repeal of Banking

Act) of rising wages and security for Americans is being realized with

millions of layoffs and foreclosures. Not reported on the major news stations

were the 10,000 + people showing up to apply for a job at Wal-Mart in Atlanta

Georgia. Besides homeowners - renters are being put out in the cold with

landlords being foreclosed on. "Remember you are just an extra in

everyone else's play". FDR

-

-

-

-

- Detroit (no debates held here) has been in a free fall

for the past seven years. Hundreds of thousands in Michigan are without

work. The drop out rate in schools is 70%. With foreclosures the highest

in the nation (there's great competition) funds needed for local programs,

schools, etc, are unavailable. No tax revenue. Per usual, you'll hear the

victims being blamed, not disreputable bankers. If only they hadn't asked

for a living wage (to keep up with inflation). If only they (auto workers)

would work for Third World wages they wouldn't be out of work. Meantime

the CEOs (corporate) of these echoing plants make 400X that of the ordinary

worker. Their pensions aren't stolen. The golden parachutes they receive

are in the multi - millions (even if they have brought their company to

ruination). Hotels, office buildings, and thousands of homes are boarded

up in Detroit. Meantime hundreds of thousands are homeless or forgotten

in noxious formaldehyde FEMA trailers. Go figure?

-

-

-

-

-

-

- McCain has told those out of work - "The jobs are

never coming back". John, whose wife's trust, recently purchased

them a $5 million exclusive condo in Phoenix, hasn't got a clue of the

suffering and fear of these folks. His advice, "Go back to school

and get that college degree - get some job retraining". John, busy

trying to catch the brass ring, neglected to tell folks that President

Bush has cut funding for job re-training by one billion dollars (amongst

many other domestic programs). Bush Budget - AFL-CIO, Mike Hall. Thankfully

for John, after divorcing his first wife, when his salary was a mere $45,000,

he married an heiress. No job retraining for him. What John is oblivious

to, is the fact that thousands of college graduates (with several degrees)

are looking for work. Duh - like Wall Street. How one secures a college

degree living in a shelter -tent - car or FEMA trailer, miles from nowhere

(in cornfields) beats me?

-

- "Who said the free? Not me?

- Surely not me? The millions on relief today?

- The millions shot down when we strike?

- The millions who have nothing for our pay-

- Except the dream that's almost dead today."

-

- "Sure, call me any ugly name you choose-

- The steel of freedom does not stain.

- From those who live like leeches on the people's lives,

- We must take back our land again,

- AMERICA!" --Langston Hughes (Great Depression)

-

- jdthmoriarty@yahoo.com

|